NITIN SPINNERS LIMITED (NITINSPIN)

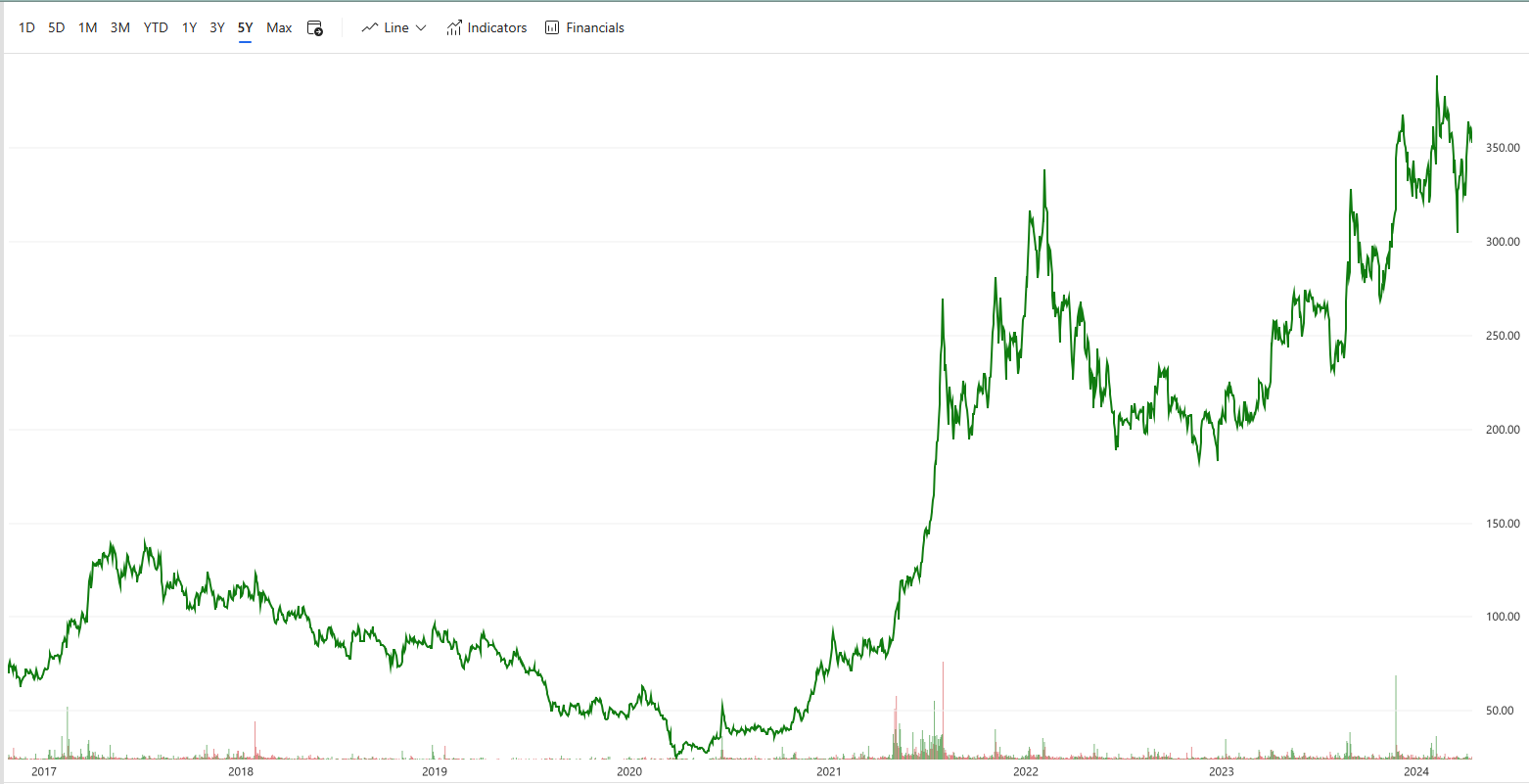

Price : 352.95 AT CLOSE -5.85 (-1.63%) AS OF 4/12/2024, 06:29 PM IST

- Market Cap₹ 1,984 Cr.

- Current Price₹ 353

- High / Low₹ 395 / 225

- Stock P/E15.2

- Book Value₹ 191

- Dividend Yield0.71 %

- ROCE11.9 %

- ROE17.2 %

- Face Value₹ 10.0

COMPANY DESCRIPTION:

The textile industry is the focus of Nitin Spinners Limited, an Indian enterprise. The company produces finished woven fabrics, knitted fabrics, and cotton yarn. Its assortment of yarns includes, among other things, cotton compact ring spun combed yarns from Ne 12 to Ne 100, cotton ring spun carded yarns from Ne 12 to Ne 50, poly/cotton blended ring spun yarns from Ne 10 to 50, and core spun yarns among others. Among the knitted materials it offers are single jersey,

The key components of Nitin Spinners’ consistent success in the textile industry are a committed workforce and a clear vision. The company was founded in 1992, and its main office is in Bhilwara, Rajasthan. We are the top producer of finished woven fabrics, knitted fabrics, and cotton yarn in India. The Company was established in response to the evident need for superior goods and services in the Indian textile industry.

There are lot of cotton mix fabrics with lycra mixed content, rib structures, pique structures, interlock structures, and three-therm fleece materials. It provides finished and printed fabrics in a variety of weaves, including twills, gabardines, broken twill, ripstop, canvas, Mattie’s, ducks, plain, and dobby, as well as cotton, cotton spandex, poly/cotton, and poly/cotton spandex. It also offers fabrics that are bleached, dyed, printed, and yarn-dyed with special finishes like Teflon and wrinkle-free.

5-Years Stock Analysis of NITINSPIN :

PROS

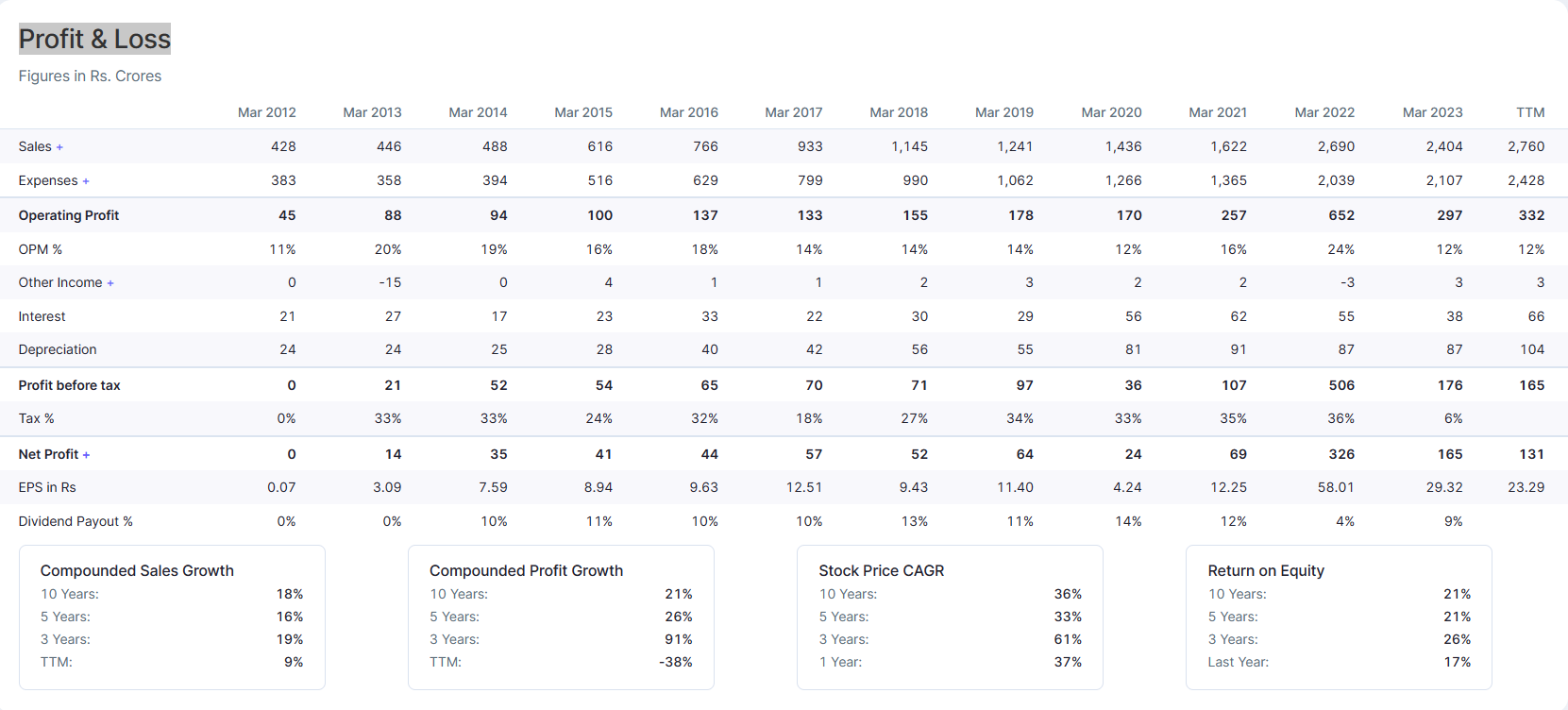

- Company has delivered good profit growth of 25.7% CAGR over last 5 years

- Company has a good return on equity (ROE) track record: 3 Years ROE 25.5%

- Company’s median sales growth is 15.8% of last 10 year

CONS

- Company might be capitalizing the interest cost

Profit & Loss

[…] 1. Stock Analysis: NITIN SPINNERS LIMITED (NITINSPIN) […]